We are living in the era of diaspora entrepreneurship. It has become a global force, fostering ecosystems across borders — in the USA, 55% of unicorns are founded by immigrants.

Brazil is no exception. Once known for exporting commodities, the country is becoming an exporter of talents — founders, investors and tech professionals that are building and scaling companies in every continent.

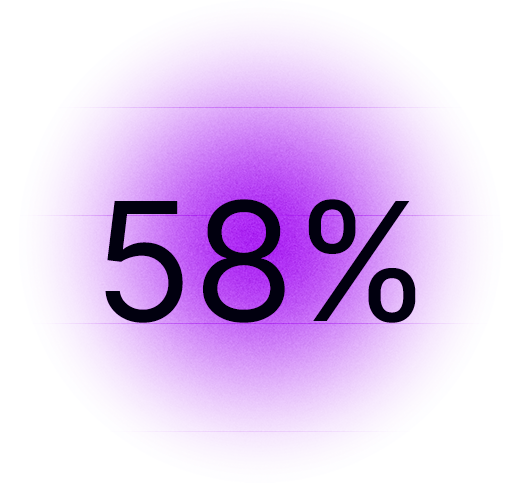

We mapped nearly 400 Brazilian tech founders, investors, and executives and interviewed 58 of them to understand their impact, ways of giving back to Brazil and practices for a soft landing.

Entrepreneurs, investors, and tech executives in the diaspora bridge and connect businesses in an international context, as they possess knowledge and experience from both their home country and the global market.

Diaspora Brazilians live in 138 cities, across 31 countries and 5 continents.

While Silicon Valley remains a major hub of capital and talent, Brazilians are leading global businesses across the U.S. and elsewhere.

Business success today depends more on access to networks and global capital than on proximity to headquarters.

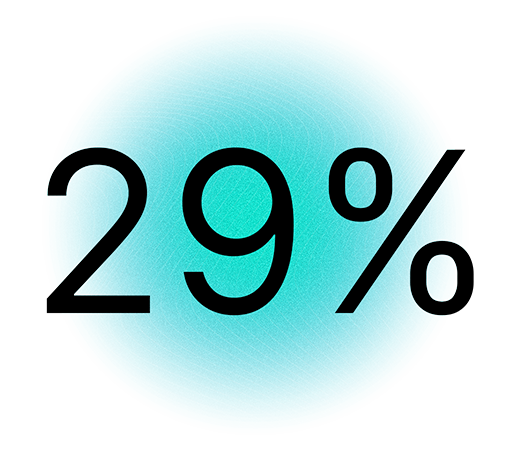

Globally, 1 in 4 Endeavor Entrepreneurs builds businesses outside their home country. Among them, 29 Brazilian entrepreneurs are making an impact from California to the Netherlands.

The U.S. remains the top choice for Brazilian founders. The market size is significantly higher—what is considered a success in Brazil is just the starting point in the U.S. Entrepreneurs must adapt to a more competitive and innovation-driven environment, where failure is part of the learning curve.

California is home to some of the world’s top investors and tech talent. Silicon Valley leads in AI, biotech, and deep tech, while Los Angeles is becoming a hub for media and gaming. Access to capital and expertise is unparalleled—but so is the cost of living. Many founders start elsewhere before making the leap to California.

Miami has transformed from a retiree destination into a fast-growing innovation hub, with no state income tax and strong links to Latin America. Nearshore outsourcing and a growing investor scene make Florida a compelling option, especially for those focusing on regional expansion while maintaining close ties with Brazil.

A major financial and corporate hub, New York offers direct access to capital markets and high-profile clients. However, the city’s high costs and networking culture demand careful planning. For those in AI, fintech, or consumer goods, NYC can provide valuable opportunities—if founders are prepared for a high-stakes environment.

Atlanta’s strong corporate presence makes it an ideal base for B2B entrepreneurs. Its strategic location allows easy access to major U.S. cities, though venture capital activity remains relatively conservative.

Boston and Cambridge are global leaders in biotech, deep tech, and edtech, driven by top universities like MIT and Harvard. Entrepreneurs benefit from the research network and investment ecosystem, as well as a large Brazilian community.

Scaling in Europe requires navigating different regulatory environments and funding landscapes, from Portugal’s emerging startup scene to Switzerland’s deep-tech expertise. The UK provides strong access to capital but presents cultural adaptation challenges, while Portugal offers a cost-effective base with easy EU market access.

Singapore has become Asia’s top destination for venture capital and innovation, with strong fintech and deep tech sectors. As a business-friendly hub, it offers easy access to markets like China, India, and Indonesia. However, investor expectations are high, and trust-based networking is essential for success.

Australia and New Zealand offer opportunities in fintech, cleantech, and agritech. With strong R&D incentives and a manageable market size, startups can test and scale before expanding to Asia-Pacific or the UK. The region also provides high quality of life and favorable visa options.

The startup scene is capital-rich but still evolving, attracting expat entrepreneurs. Saudi Arabia is investing heavily in tech and innovation, though business relationships take time to build. The region presents opportunities particularly in real estate, fintech, and AI.

Source: Data on Brazilian Endeavor Entrepreneurs living outside their home countries, verified by the Endeavor Brazil Team through February 2025.

How high-growth Brazilian entrepreneurs are scaling and reinvesting their success

CEO of Prosus and Naspers

Since the early days of iFood, Fabrício had one goal: build a world-class company. After Leading one of Latin America’s most successful tech companies, he joins Prosus he can take that ambition even further.

“I have always dreamed of creating a global leading company. This has always been iFood’s mindset. We’re building global companies in Brazil, India, Africa, the Middle East, and Europe. These markets are full of potential.”

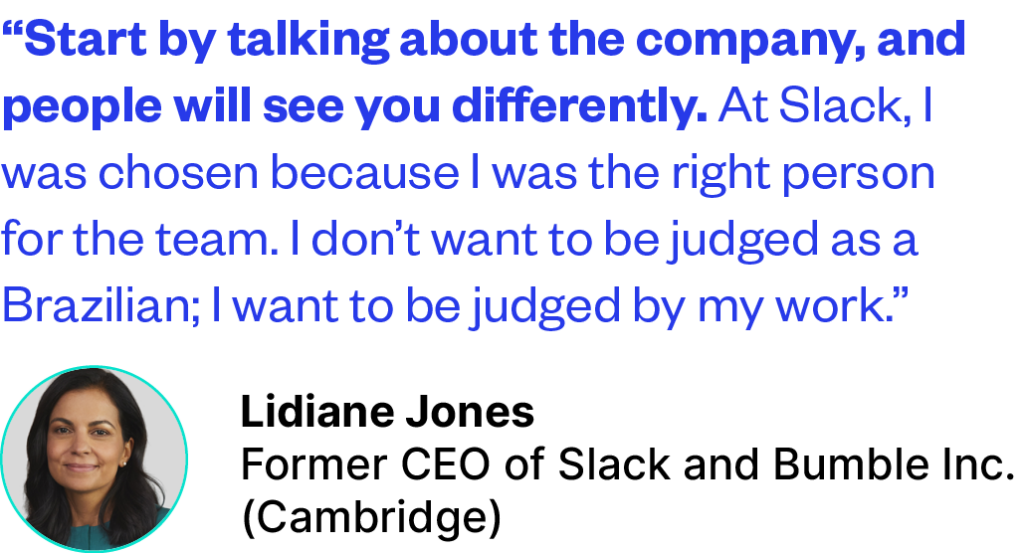

Fabricio acknowledges that Brazilian entrepreneurs still face some skepticism abroad. But he believes that Brazil can become more relevant in terms of innovation.

“When global investors and executives talk about the future, Brazil is still left out. We need to create more success stories so that the world places Brazil back as a priority.”

And even with Prosus headquartered in Europe, Fabrício sees giving back to Brazil as a responsibility, not an option.

“Entrepreneurs who succeed owe it to society to give back. We’re lucky to have had access to education, lucky to have built companies in uncertain environments that still worked. It’s about sharing knowledge, mentoring, and investing in the next generation.”

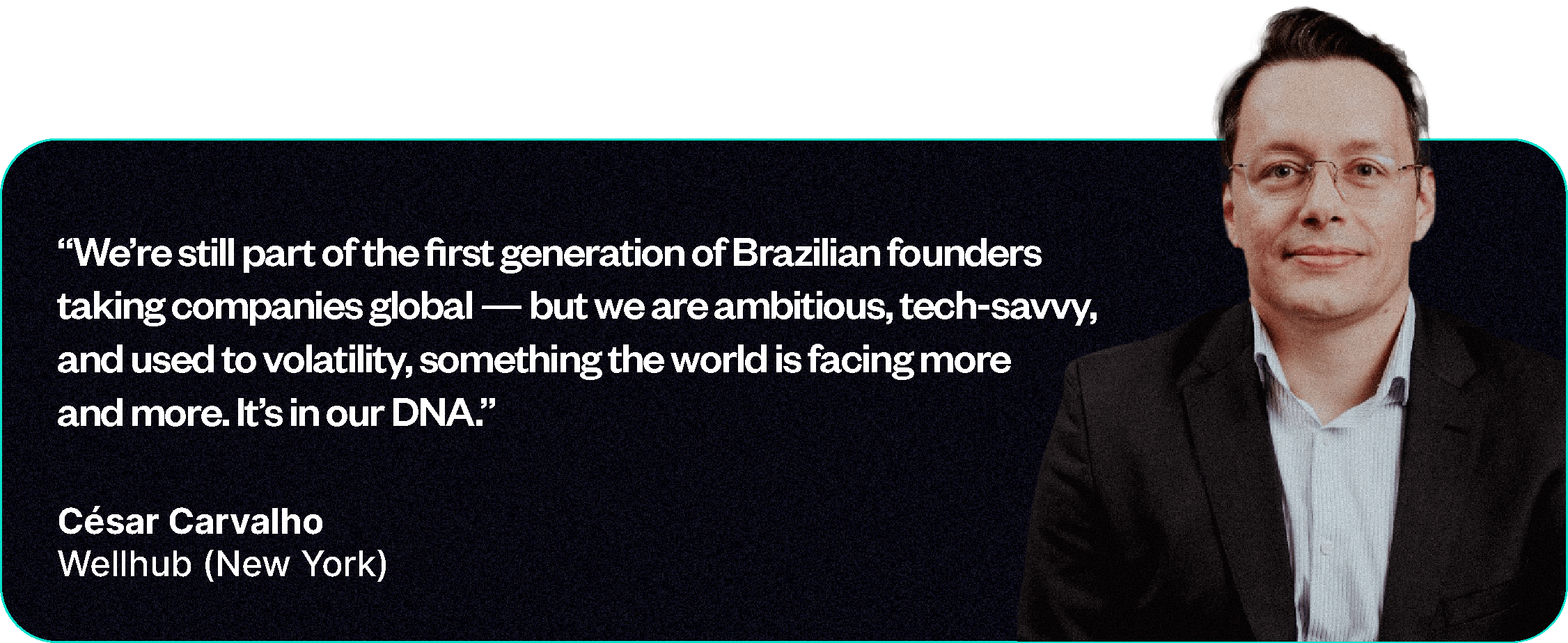

Cesar moved to New York with a clear objective: to accelerate Wellhub’s global expansion.

“The market is so large that it can seem advantageous to operate exclusively within Brazil and never expand internationally. But that’s not always true.”

New York made it easier to recruit world-class talent, secure international investments, and reshape external perceptions. However, Cesar admits that being underestimated is a common challenge for Latin American founders.

“From an investor’s perspective, there is a lack of examples of entrepreneurs and companies from LATAM building businesses in the United States and Europe. Having more success stories increases the investor appetite for such ventures.”

As more Brazilian-founded companies expand globally, investors are starting to recognize the untapped potential in Latin America.

“As the world becomes increasingly uncertain, Brazilian founders have the advantage of navigating through turbulent times.”

Wellhub expanded to 11 countries, with the U.S. representing a significant share of revenue. Despite its international success, Cesar remains deeply connected to his Brazilian roots, investing and mentoring entrepreneurs.

“Scaling a company globally doesn’t mean leaving Brazil behind—it means elevating it and also giving back to the new generation of founders.”

Mariano relocated to London to position VTEX as a global leader in e-commerce.

Founded in 2000, VTEX had seen significant growth in Brazil, but Mariano couldn’t wait for full consolidation at home: in 2012, VTEX began expanding into Argentina, Colombia, Chile, and Peru.

“I do not believe in the argument that Brazil needs to be conquered first.”

By 2016, the time had come for the U.S. Relocating VTEX’s headquarters from Miami to New York paid off: in 2021, VTEX went public on the NYSE, successfully delivering on all its IPO commitments.

“The European and American markets still see Latin America as a commodity hub, not a tech ecosystem. We had to prove otherwise.”

Mariano reflects on giveback. For him, financial contributions come first, not time.

“Giveback isn’t optional, it’s essential. Brazilian society has the potential to increase its charitable donations from 0.2% to 3%.”

VTEX’s playbook is also open and accessible to the public to inspire other entrepreneurs. For Mariano, this is just the beginning.

“If we succeed, we’ll have built a brand that paves the way for 10 more companies. We’ll have transformed Brazil’s global perception—establishing “Made in Brazil” and “Engineered in Brazil” as hallmarks of quality.”

Diaspora entrepreneurs operate highly technical and global businesses.

Thanks to companies like Nubank and Creditas, Brazil has established itself as a global player in fintech. Despite making up only 17% of Brazilian-founded companies abroad, Fintechs secured $4.45B (44% of total capital), largely driven by Brex’s late-stage rounds.

Brazil plays a relevant role in early-stage investments, but still loses traction in later rounds. Most Brazilian-led startups abroad are in early funding stages, with Seed (28%) and Angel/Pre-Seed (22%) rounds leading. While Series A and Series B represented 12% each, only 3% of companies reached Pre-IPO/IPO stages.

For them, being a diaspora entrepreneur and going global means:

Interviews with 58 Brazilians revealed two primary migration drivers: personal motivations and opportunity-driven factors.

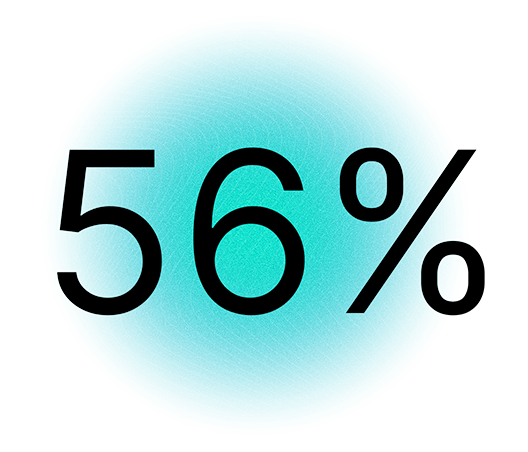

While most (53%) migrated primarily for professional or business opportunities, 44% cited at least one personal factor in their decision.

Career (81%)

Business Expansion (32%)

Education (19%)

Family (21%)

Public safety in Brazil (18%)

Exit or liquidity event (12%)

Brazilians who migrate for opportunity seek ecosystems that offer stronger support for innovation, career growth, and global scaling—filling gaps that persist in Brazil.

Among the 28 entrepreneurs interviewed, 11 gained executive experience abroad before launching their ventures, while 17 dove straight into founding their businesses overseas.

For investors focused on global growth, Brazil can sometimes feel like a ceiling.

Brazil’s investment in R&D and infrastructure remains low in biotech and AI compared to larger markets.

Local companies tend to license international technologies rather than develop their own. AI-enabled companies often thrive with product-based solutions.

Brazil continues to prioritize distribution over innovation, limiting its global reach.

Since big tech subsidiaries in Brazil primarily focus on sales and marketing, long-term careers in the country can lead to stagnation.

Safer environments provide children with greater independence, reduced social isolation, and the freedom to move around cities.

After an exit, entrepreneurs often reflect on their lifestyle and work routines.

Entrepreneurs also cited financial factors, such as:

Economic instability in Brazil, with volatility making it difficult to focus on the strategic priorities of their businesses;

Exchange rates with growing disparity between the Brazilian real and the U.S. dollar, making a return to Brazil less attractive;

Tax burden, especially on the repatriation of funds.

For most Brazilians abroad (81%), relocating to Brazil is not part of their plans—a reflection of their deep integration and consolidation of life overseas. For companies, 2-3 years of offshore operations and complex cap table structures often make returning to Brazil unfeasible.

While Silicon Valley remains a major hub of capital and talent, the demand for high-growth entrepreneurship is driving Endeavor’s expansion wherever founders want to be—88% of Brazilians are exploring opportunities in both advanced and emerging ecosystems.

But what does it take to land and thrive in these markets?

Our interviewees shared insights on opportunities and challenges, reflecting on whether their expectations matched their experiences as emigrants.

Hurdles and opportunities faced by the Brazilian diaspora

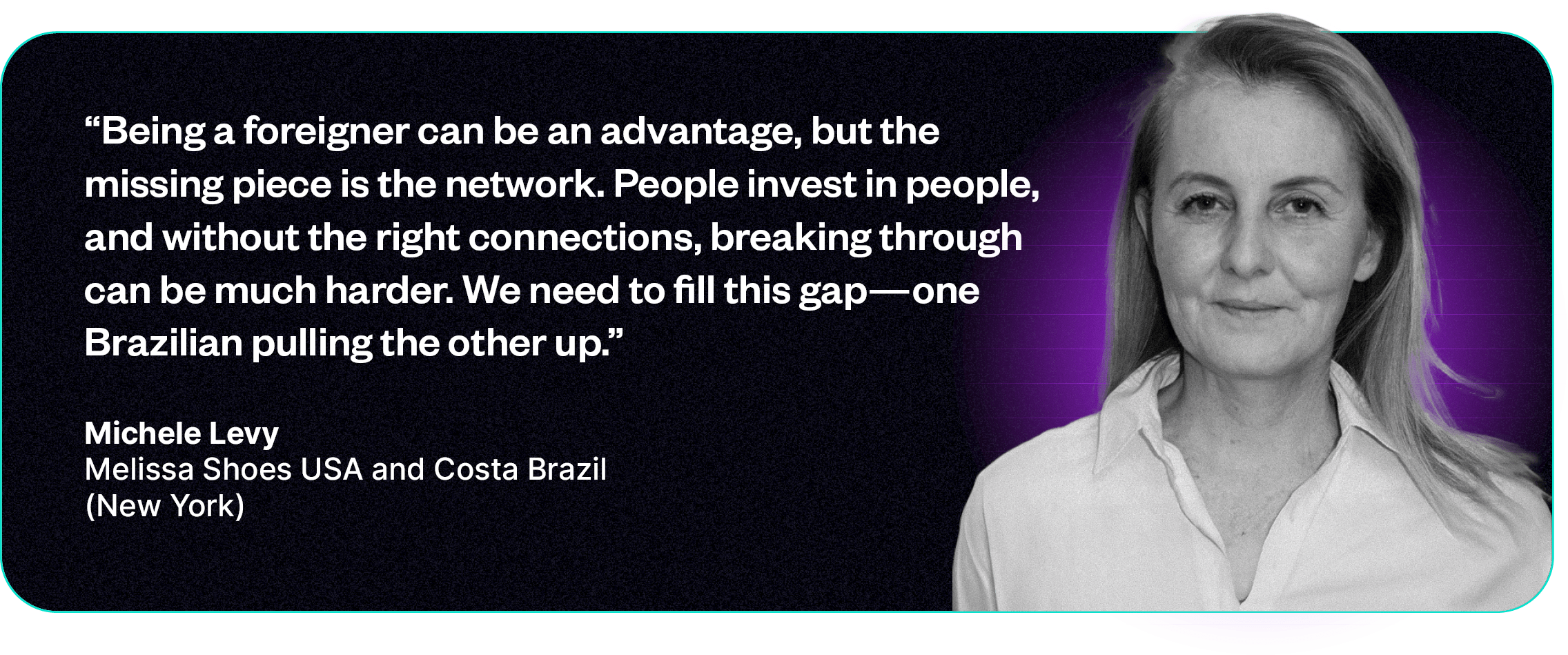

Networking (81%) Building meaningful connections in a new ecosystem directly impacts access to business opportunities, clients, and investments.

Adjusting to social and professional norms affects both daily life and business operations.

Even second time founders face difficulties understanding the market and securing funding abroad.

Many entrepreneurs must prove their credibility and value when entering international ecosystems.

The power of the Brazilian diaspora’s giveback for the Brazilian ecosystem

Going global doesn’t mean leaving home behind. Most Brazilians remain connected to their home country and contribute to the local ecosystem in multiple ways, forming a strong community and support network.

The international community of the Brazilian diaspora is an asset for Brazil’s scale-ups.

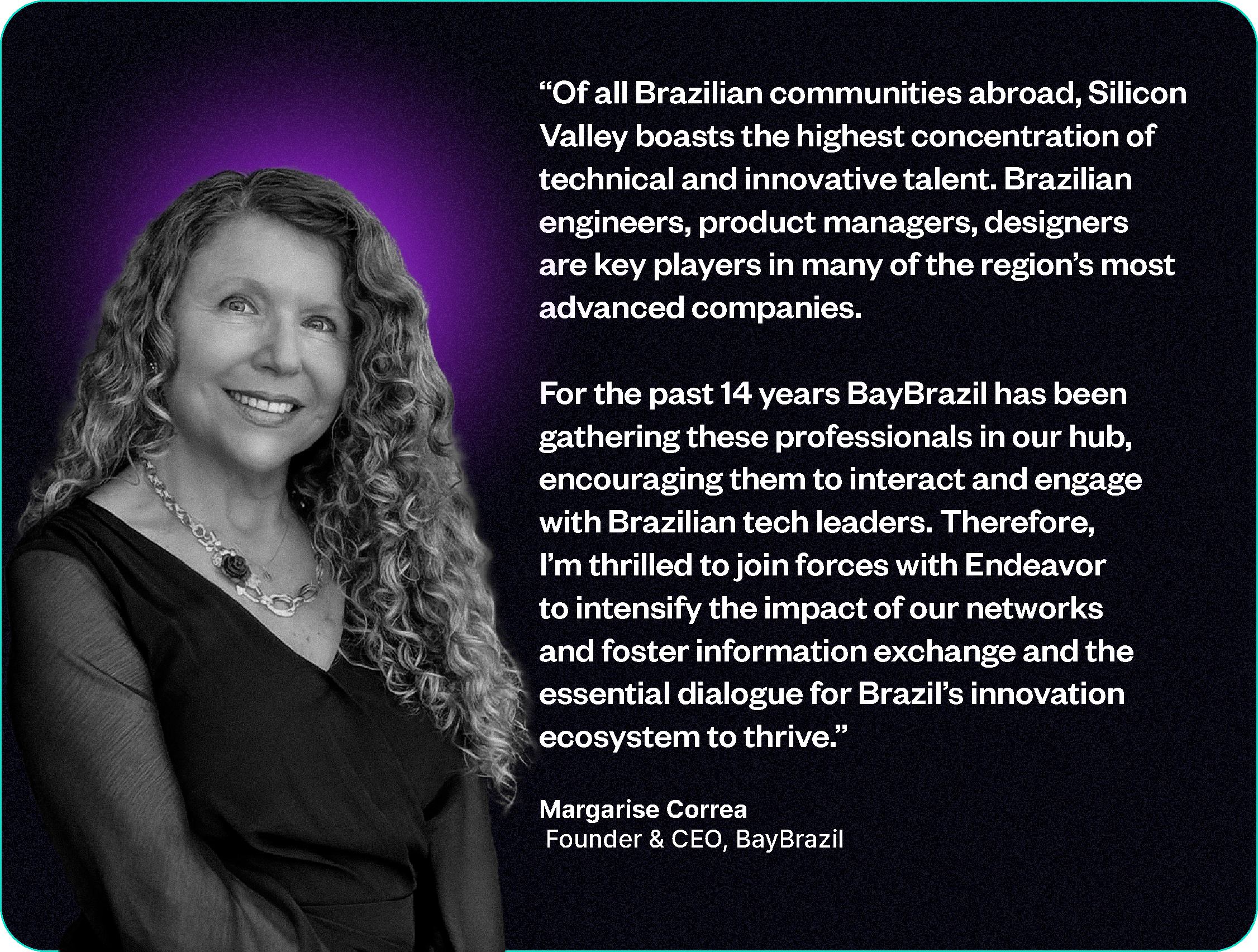

While 60% of respondents engage in community initiatives with fellow Brazilians, 65% feel these communities could be better developed.

We are the leading global community of, by, and for high-growth entrepreneurs — those who dream bigger, scale faster, and reinvest their success. Driven by our belief that high-growth entrepreneurs transform economies, Endeavor has been on a mission to build thriving entrepreneurial ecosystems in emerging and underserved markets around the world since its creation in 1997. Endeavor Brazil Research provides data-driven insights and practical case studies focused on the drivers of Brazil’s entrepreneurial ecosystem. Leveraging global expertise, our studies explore the factors that foster high-growth entrepreneurship in Brazil, offering valuable knowledge to help founders scale and strengthen the local innovation landscape. For more information, contact karina.almeida@endeavor.org.br.

Disclaimer

This report is an independent research initiative led by Endeavor Brazil. Although the authors collaborated with a range of organizations and experts for this study, the methodology, data interpretation, and conclusions are the sole responsibility of Endeavor Brazil. These are related to the Brazilian diaspora and do not necessarily reflect the views of Endeavor Global or other Endeavor offices.

This research was inspired by earlier work conducted by Endeavor Insight — the organization’s global research team. To learn more, visit endeavor.org/research. For inquiries about future diaspora-related research in other markets, please contact insight@endeavor.org.